The goal of this trading drill is to be flexible in your market bias and to make the most of current trading conditions under pressure. You will need a timer and a coin and the same setup as in Exercise #1, which is one DOM with just the Bid and Offer depth listed, and trades accumulating at the current price or inside market bid and offer. In addition to this you can enable the volume profile within your DOM to assist in counting how much volume is accumulating at prices, and to consider the order flow in the context of the volume profile.

- Start your timer for 10 minutes and flip a coin. Heads means you are looking for a long, Tails looking for a short and you have until the timer alarms to get filled according to this bias.

- If the timer expires you must hit / lift into the market (buy or sell at market). Use order flow logic for finding the best fills within your time constraints and for managing your exit (read Exercise #1 for what to look for here). Do not use the shape of the volume profile in this exercise to blindly take trades.

- Start the timer again once you have exited your position and flip a coin.

- Your mental stop loss should be within 3 – 5 ticks depending on the market traded.

- Once you have exited your trade and started the timer, immediately turn your focus to your next trade regardless of the outcome of the previous trade. This can be difficult but is an essential discipline to master.

Flip a Coin Exercise Points

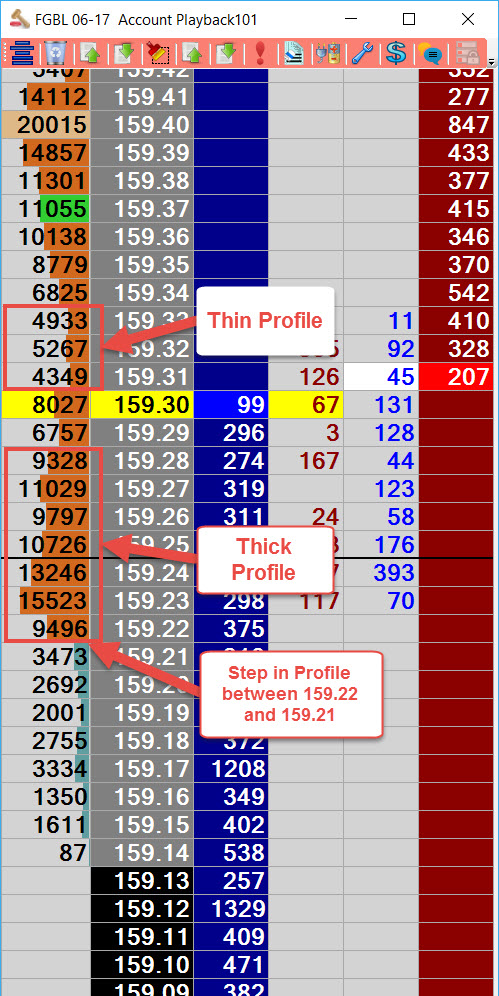

- Observe how the order flow behaves around ‘steps in the profile’. This is where there is a significant gap in the profile thickness between consecutive prices. Also notice if any difference in the order flow where the profile is thick verse thin.

Volume Profile Basics

- Do not exit a position simply so you can start the timer again – this is cheating the exercise to reduce the pressure on your trading.

- If the market moves immediately against you due to an unfavorable / difficult entry, focus your attention instead on trying to get a scratch (exit at the same price you entered at).

- Do not allow a favorable position to turn into a loss. A favorable position being where you have a couple of ticks profit, and room for the market to zig-zag its way further in your favor. This is sometimes called a ‘free look’ because you can now let the order flow game play out in the DOM without the stress of minimizing a loss.

- You should rarely be in a position for more than 20 minutes in this exercise.

This can be quite a difficult exercise due to the pressure of the timer, forcing you to continually judge the market and form a bias. Once a trade is over, since the clock is ticking, you have to shift 100% of your focus on to the next trade.

Traders are usually making money in both directions, and the market is rarely unidirectional – it will zig and zag in the short term, with opportunities on both sides. Some traders tend to be better playing the short term reversals, while others are better at getting a fill on a pullback for a continuation of the short term trend, and you will hopefully gain experience in both these situations due to your random bias.

Trading Drill Review

If you haven’t read the Exercise 1 review then read that section now as it gives a foundation for efficiently reviewing the trading session. Because this exercise forced you to take trades in a random direction then your patterns on the one minute volume chart are potentially going to be different from Exercise 1. You will still have to overcome the same trader errors and rookie trade sequences, however by taking directional discretion out of the equation there should be less chasing of trades in the same direction. Following are some review notes particular to this exercise (in addition to the Exercise #1 review points):

- Are you consistently placing trades immediately after you exited your previous position (soon after the timer starts)? This can be a sign of overtrading once again. You have a 10 minute window to read the order flow and work bids and offers in logical locations so you should be using this to your advantage. If you think you might have an issue with overtrading:

- Complete Exercise 1 again with one important condition. You have only 3 trades up your sleeve for the morning trading session. Focus intensely on the order flow and use your bullets wisely. If shaken out of a trade you must build a very strong case for taking the next trade with the same idea otherwise exercise some patience and look for a new opportunity.

- Since you are (hopefully) completing these exercises on the Sim it is possible that you are not taking the exercises seriously enough and just want the thrill of being in a trade so are entering trades without much logic. This can also be a sign of gambling style trading. Consistently profitable trading requires trading systematically and not getting too hyped up over any one trade. If you think you might be taking trades for a thrill instead of for reasonable order flow reasons in this exercise, then ask yourself before clicking the mouse:

- Is this a logical trade or am I bored?

- Is it probable that a better opportunity will present itself within this 10 minute window?

- One of the exercises in this book focuses on trading systematically Note: If you have an issue trading on sim and have the funds to lose, you can try ‘upping the ante’ by trading live with 1 lots for the sake of these trading exercises, though you must be ok with losing your funds as a cost for learning.

- If you are consistently entering at market towards the end of the 10 minute time window then your 1 minute chart review should help reveal if you were simply not firing when opportunity did present itself. It is normal to work bids and offers for a good fill and then miss out on the only opportunity during this time window, and for very limited opportunities to present themselves in any one particular session (that is discretionary trading for you). Focus during the next session on trying to get a good fill, and if it looks like you aren’t going to get filled, click in at market (buy or sell at market). You still may find you get whipsawed, however this a lesson on how a move generally gets underway once multiple ‘shakeouts’ have occurred, removing the weak-hands prior to a move.

- If your review shows that the 10 minute window is just too short a time window for finding order flow opportunities in your market in either direction then you can push the time window out to 15 minutes.

This exercise should teach you a lot about market behavior and your trading mindset. It is possible to be profitable in this exercise despite not having a say in whether you are looking for a long or short each trade.

You need to understand this through experience so make sure you take your time with this exercise. If you feel you are getting a lot out of this exercise then don’t be afraid to complete it for two or three weeks if you have the time.

Resources

Next

– Trading Exercise #3 – Always in the Market

Prev:

– Trading Exercise #1 – Trading Naked

– Preparation for Trading Exercises

– Introduction to Prop Shop Trading Exercises