Trading naked is a benchmark trading exercise that you can look back on to see how your entries and exits improve as you progress through the exercises, gain experience, and learn from your mistakes. Have just a single DOM window open for your chosen market with only the market depth bids and offers displayed, and use the accumulated trades at the current price (or bid and offer if using the Jigsaw Trading DOM) in the context of the market depth (Bids and Offers). For those new to the DOM this can be quite overwhelming initially and it is normal to ‘crave’ charts or do some analysis before pulling the trigger on trades, however stay disciplined and purely watch the ‘prints’ (trades in the DOM).

‘Trading naked’ like this will give you a deeper understanding of how the market auction process works, with buyers and sellers being matched with aggressor trades (market orders) and momentum changing from more aggressive sellers to buyers and back again, and so on. Professional traders can gauge the market sentiment and even tell you how much is trading at each price just by watching their DOM. There are trading tools to make this simpler which you can take advantage of, though their value is exponentially increased once you have done the work and learned to read the market auction process here in the DOM.

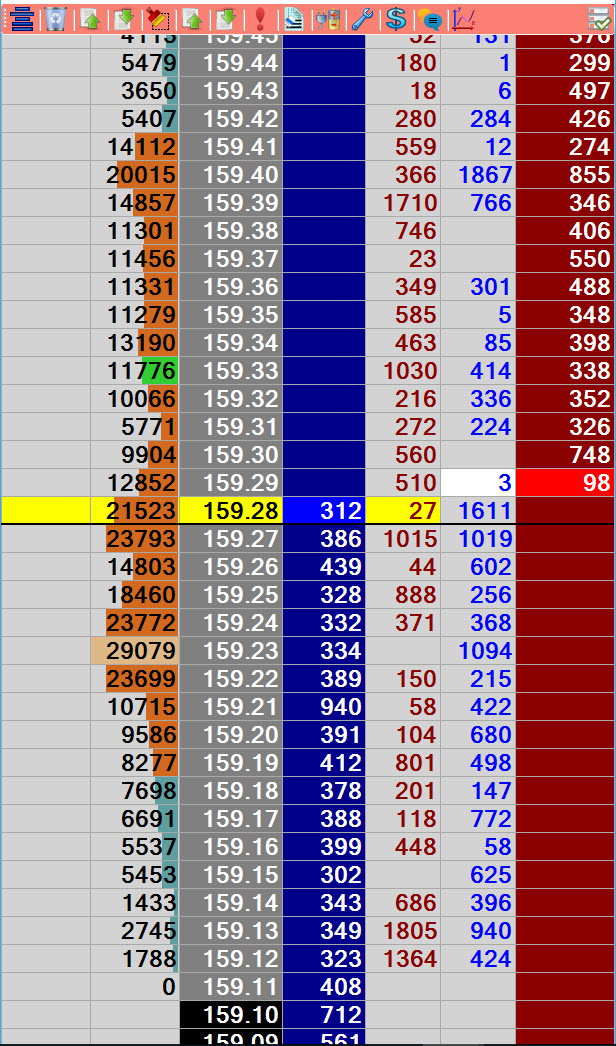

Jigsaw Trading DOM

Trading Naked Exercise Goal

The game here is to get in and out of the market using the short term order flow. This generally means you are in the market for a matter of minutes. For those with some experience trading using the order flow – just do your best working bids and offers, hitting in as a last resort for moves and getting out when you’re wrong. Make sure you are aware of relevant economic releases / speaker events during the session and manage your positions around them – Do not hold through significant economic numbers. See the links section for economic release websites. If you are completely lost on how to trade with the DOM, then it could be worth checking these guys out before continuing with the trading exercises below:

- John Grady’s No BS Day Trading basic course will take you through the basics of trading with the DOM and a full introduction to day trading

- Jigsaw Trading also have plenty of material, such as their free order flow analysis lessons

For this exercise try and place limit orders for fills (also known as ‘working the book’). Use market orders sparingly if you think an opportunity is about to leave you behind. Only enter the market for good reason e.g. A lot of absorption on the Bids, followed by aggressive buying. Exit the market when your reason for being in the market has been negated e.g Absorption on the offers and / or aggressive selling. You aim to enter where you know within a few ticks (sometimes one tick for thick markets) if you are wrong. These are some of the things you can look out for in the DOM to take advantage of:

- Look for large bids and offers that the market is testing and either lean on them (trade in the same direction) or wait for the market to break through them

- Are buyers hitting into an abnormally large Offer or are they standing aside to see what happens and similar for large Bids

- Get a feel for the motion of your market. How many ticks does it generally move up before buyers stop ‘lifting’ the offer or sellers start ‘absorbing’ at the offer

- Pay attention to the ranges trading as the inside bid and offer move up and down the DOM ‘ladder’ and play reversals at range extremes or breakouts of the range

- Look for games in the bids and offers, also known as ‘spoofing’ where a bid or offer cranks up and then vanishes. Even though these are not legal, they occur frequently in most markets during the session

- Gauge how much volume is accumulating at the inside market (thicker markets) or within a tight range (in thinner markets) and how much volume tends to absorb momentum before a short term reversal

- Pay attention to the thickness of the Bids vs Offers – in general are there more buyers on the bid than sellers or vice versa

There are many more nuances particular to each market that you will pick up on the more you watch trading activity in the DOM. Trust what you see and try to make the most of this information. Even if you find you are out of sync with your market calls, you will review your trades at the end of the session to find out what can be done to improve.

During this exercise your goal is to try your best to make ticks. If it is a slow day you may only have one trade in an hour, and on any day (depending on the market) you should rarely be in a position for longer than 30 minutes based on short term changes in the order flow. Even though you might feel helpless with all the flickering of numbers, do your best to stay focused, form a bias from the order flow and actively look to take trades for 2-3 hours. Once the market starts to grind with little volume trading relative to the peak session volume flow, stay focused for another 15 minutes just to be sure (you will never know for certain) before counting your ticks for the day.

Trading Naked Exercise Review

This process is the same for the trading naked exercise and future exercises. It helps to complete your review with a fresh perspective after having taken a break or later in the day when you are relaxed. The review shouldn’t take more than 10 minutes and if you record your trading screen during the exercise try and fast forward to when you know the opportunities were taken AND missed, make some notes and move on. You want to be ending the review pumped to do better the next session so stay in a positive mind-frame and focus on a few things to improve on. Open a one minute chart with volume for your review and overlay your fills. In XT / TT this is achieved using the Fill indicator. In other platforms you can usually turn on and off your fill overlays.

Exercise Review Chart

Things to take note of for improvement:

- Early Timing. Are you trying to play reversals by entering the market too early and getting run over? This is easily seen as getting long in the middle of a down bar or vice versa, or before the price action has obviously stopped. Patience is the key here. Try and implement some mental check-boxes in the next session e.g. – 2000 contracts have traded at these prices (volume check) which should be enough absorption for a short term reversal – The market has traded at these prices for over 10 minutes (time check) at these prices with obvious lack of interest in continuation of the previous move. – Iceberg orders followed by aggressive market orders in the new price direction (order flow check). Note the market rarely reverses immediately without some sort of accumulation / distribution so you usually have time to work bids and offers and anticipate minor reversals.

- Late Timing. Are you often missing out on good moves or getting whipsawed? This can be a case of looking for too much confirmation to take a move. Try and adjust your timing in the next trading exercise session by getting in when you have just enough justification to take on a small amount of risk. This can also be a sign of fear of being wrong and waiting for too much information. Remember, trading involves taking risk AND losing trades. We will work on probabilities in the next exercise.

- Rookie Sequences. These generally result from lack of patience and trade logic. The above review chart highlights a rookie sequence. Say you got long at what looks like a reasonable price when you look at your review chart. You then got shaken out for a few ticks loss. You get long again and once again are shaken out. Rookies will try to re-enter the same position at the same or worse price, multiple times in a short period instead of taking into account the new information learned from getting shaken out. – One remedy is if shaken out from a long position, only work your long orders again at a better price than where you last exited and vice versa for shorts. – You can try the three strikes and out rule here too but two strikes is generally enough to sit aside for a while i.e. If you tried to get long preempting a move 3 times unsuccessfully – forget about that move.

- Rookie Breakouts. There is no problem playing breakouts if you have observed buying and selling in a tight range in your DOM or for example a large refreshing offer / iceberg gets eaten by buyers then goes bid. Timing is always difficult but a rookie will tend to hold onto the breakout idea too long. If that large offer order that was consumed reappears or your reason for expecting a breakout gets negated, you need to get out quickly as this scenario is where a lot of traders get trapped.

- Over-trading. The next exercise should help change this as you are limited by time and bias. If you look at your one minute chart and cannot remember the reasoning behind individual trades, this is a good sign that you took too many trades with weak reasoning. Some solutions: – Consciously build a case for each trading decision buy or sell / entry and exit. As experience grows this will be come automatic instead of a conscious process. You should be able to look at the chart during your review and know your arguments. – For chronic over-trading you should try 2 or 3 sessions trading with a limited number of bullets to fire. Limit yourself to just 3 trades for the next 2-3 hour session and make them count!

Resources

Trading Drill Video

https://youtu.be/h7XwWBqSadI&modestbranding=1&rel=0&iv_load_policy=1&autohide=1&start=8&showinfo=0

Links

No BS Day Trading – Never seen a DOM before? Check out the free videos at No BS Day Trading to get an idea of order flow to observe in the DOM when doing these trading exercises. John’s basic course is a great compliment to these drills to get you started on the right track, and it is also on the recommended reading list of some prop firms.

Jigsaw Trading – Check out the free order flow course material which also includes one or two trading drills with video. The Jigsaw Trading DOM is a professional DOM designed by traders, for traders and is the ideal DOM for completing these trading exercises with.