Mark Douglas in the renowned trading psychology book ‘Trading In The Zone’ treated a broad range of trading issues with a simple systematic trading exercise. In his Path to Consistency Workshop, he discusses the details of the systematic trading exercise and the purpose behind it. While trading psychology is like going down the rabbit hole for many a new trader who tries to solve mental trading issues before actually having learned to trade, an exercise in a systematic/mechanical trading strategy will help you learn to take all your trades, despite uncertainty in your ‘read’ on market conditions, so with just a slight edge in the markets, the probabilities can ultimately work out in your favor. You can then look for a trading platform to work from when you have a better understanding of how the system works. Looking into platforms like TrendSpider (no affiliation) can show you what trade timing strategies are available and signals to systematically execute for this exercise.

According to Douglas, high functioning discretionary traders have traded mechanically long enough to stay in the game to mold their intuitive feel for the market and subsequently learn when to sit aside or ‘up the ante.’ Unfortunately for anyone who hasn’t survived day trading for more than a year or two, this sort of market intuition will never develop. That is one good reason to learn to trade mechanically according to Douglas, in order to survive long enough in the game to turn the corner. With time you will also get to truly understand the market’s nuances, and how it changes over time. With a reasonably mechanical approach you might still struggle to make profits, but you won’t destroy your trading account in one day, week or month (hopefully).

One of the main reasons behind Mark Douglas’ exercise in mechanical trading is to understand probabilities. In short, you need to be able to enter and exit the market each time without too much emotional obstruction, knowing that this trade will result in one outcome that is only part of your bigger picture results. Your trading may ultimately produce 1 profitable trade for every 2 losers, with the profitable trade being big enough to balance out the 2 losers, and you can never know which trades are going to be the losers or the winners. All you can focus on is your rules. This is where it gets a little confusing, because if it was as simple as finding a mechanical system and trading it blindly then everyone would be making money trading. Well true and not true – it can be very difficult to mechanically follow your rules, especially after many hours staring at numbers on a screen waiting for your entry and exit conditions. Enough missed trades and rookie trading sequences (due to any reason) and you have removed the probability edge of your trading system. You are also still going to have come up with your own trading edge to take advantage of systematically, and adapt it to the constantly changing market conditions. This process may not be as difficult as executing the system mechanically. First you need to learn to trade probabilities, and survive the game long enough.

Trading Strategy for this Exercise

Feel free to make up your own trading rules based on previous experience, trading ideas or what you have learned during the previous trading exercises. In the Mark Douglas workshop he suggests using a simple moving average crossover system to learn the core lessons of this trading exercise, however since we are focusing on trading like a professional using the DOM to monitor the auction process, try and come up with a simple strategy that does not involve charts. If you don’t have a basic trading strategy, a default trading system is specified for the purpose of this exercise below. You will still benefit from this exercise if your strategy is not a money making machine. More important is that it is not a money burner, that it makes sense for someone to trade in that way, and that it forces you to take action at least a half dozen times during each trading session.

– would it be laughed at or shrugged at (give it a go)?

Skin in the Game

If you can easily afford to trade your system with some real skin in the game, on 1 lots or the equivalent small quantity then this will amplify the benefits of this exercise. If trading live, then make sure your trading account balance is small enough that if you lose it all as an educational cost, you aren’t worse off in life. If needs be ask your broker for risk management or a separate training account with the appropriate balance. You will definitely benefit from this exercise on the SIM, however it will help to have some sort of risk in the game psychologically. One useful strategy is to have some cash next to your trading PC separated in a WIN and LOSS pile which you must use for rewarding and punishing yourself with. Another subtle approach for those truly battling with trading with money involved (an issue these exercises hope to help you overcome) is to penalize and reward yourself with things you like such as chocolate, drinks or movies, though need it be said,

Trading Strategy for this Exercise

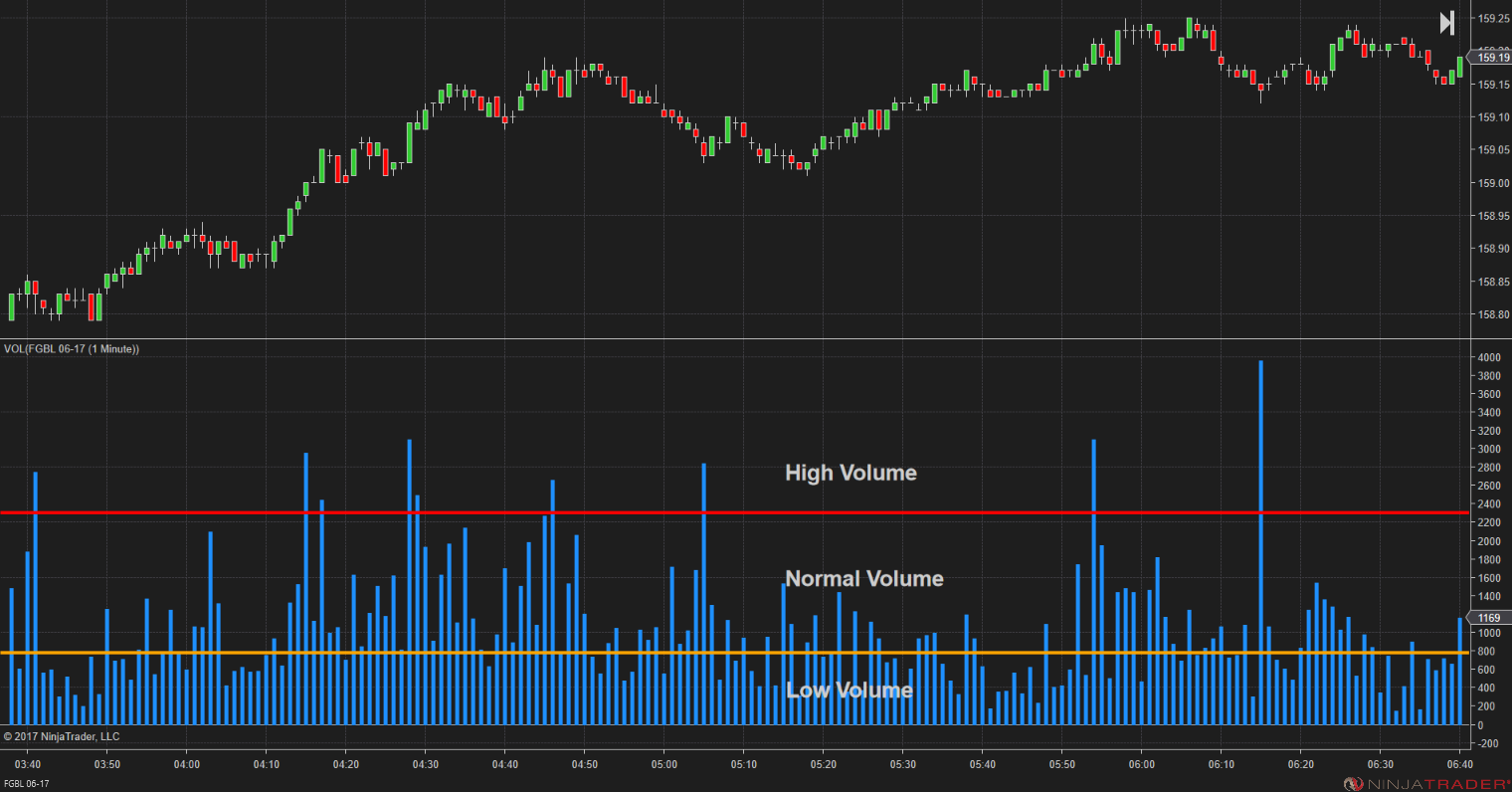

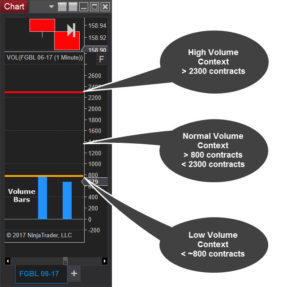

Bring up a one minute chart with volume bars enabled for your traded market. Now eyeballing the volume for this chart, divide the volume bars into three categories, low volume, normal volume and high volume, by drawing two horizontal lines across the volume bars. The high volume threshold should only have a handful of volume spikes above it. Below the high volume line and above the low volume line is considered normal volume, capturing about 50% of volume bars. Below that line is considered low volume.

Using volume as context

We are going to use what is called a ‘Mean Reversion’ strategy for trading low volume activity, which basically means we are expecting the market to trade back into its current value range. For normal volume conditions we will go with momentum as viewed in the DOM, buying and selling minor pullbacks. For high volume we are looking at trading major breakouts and reversals. Now record these values for your records and squash up your chart so you can only see the last two volume bars as shown below.

Deciding on Market Context

Use the last full one minute volume bar to categorize if you are trading as per the low volume, normal volume or high volume market context rules that follow.

You can also work on monitoring the DOM prints and / or volume profile to keep a mental map of how much volume has traded roughly in the last minute. If you are lucky to have watched traders like John Grady, you will know that these guys can recall with ease how much traded at the last few prices (give or take). Being able to maintain a mental map like this of volume will pay dividends, especially when the momentum is building. These exercises are a great opportunity to develop this skill.

Use the currently building volume bar to cross check your mental count to help improve, then when you are consistent you can switch to using your mental count of recent volume for deciding the current volume context. Just be consistent in your approach whatever you choose.

Low Volume Context Trading

Using the volume profile in your DOM, if you are in a low volume context, then as the market trades up-to the extremes of a range, identified in your DOM as a step in the profile, you are going to work orders around the step in profile for a reversal back into the range, and try to take a profit in the middle of the range where the profile is thickest. If you observe some momentum back to the other side of the range, you can try and take profits at the opposite step in the profile, then if still in a low volume context, work a position in the opposite direction.

Allow yourself 2-3 ticks mental stop loss to find out if the range will hold. A lot of games are usually played around these boundaries, with stop pushes and shakeouts occurring. Ideally you wait to observe a game play out before working for an entry. Succesfull trades in a low volume context, for the purpose of this exercise, should satisfy the relevant points below (relevant to entry or exit trades):

- You have actively worked for a position around the step in the profile but could not get a low risk entry (for example not enough market orders at the range extreme, and not enough reward to risk ratio to justify the trade)

- You have been shaken out after getting a fill at the edge of the profile (allow yourself one more re-entry attempt at a ‘better price’

- You have been filled and started working for a profit or

- Taken a scratch after multiple tests of your entry price or the step in the profile / range extreme

- Taken a profit at least equal to your risk.

Normal Volume Context Trading

When the last full volume bar is in the normal volume range then you will trade with momentum (if it exists). Since more volume has entered the market than in the low volume context, you should expect to see some more momentum behind price swings. This momentum will generally open the door for minor pullbacks while liquidity rebuilds behind price movement. Your goal is to get a fill on the minor pullbacks, with minimal risk, and trade the next price swing. Successful trades in a normal volume context, for the purpose of this exercise, should satisfy the relevant points below:

- You have worked orders for a fill on pullbacks but could not get a low risk entry (buying or selling have completely dried up and / or not enough risk reward potential to enter at market)

- You get shaken out after getting a fill at a reasonable pullback entry point (allow yourself one more re-entry at a better price)

- You are working for a profit after getting a reasonable fill on the pullback or

- Taken a scratch when the market has tested your pullback point several times or

- Taken a profit at least equal to your risk.

Note: Use the volume profile and short term order flow to gauge where pullbacks are likely to stop and where your position is likely to run into some resistance (thick profile, step in profile etc).

High Volume Context Trading

When the last full volume bar is above your high volume level then you are looking for major reversals or major breakouts. If volume is testing a major step in the profile then play the breakout up or down. If there has been a significant price swing leading into the spike in volume then the new volume flow usually coincides with the culmination of a move where a lot of volume is changing from weak to strong hands. You can choose to avoid trading in these conditions as it is not wise to step in front of a train. For the purpose of this exercise, wait for a retest of the reversal level, or if playing the major breakout, a retest of the breakout point. These will usually be obvious volume profile shapes in your DOM. You have successfully traded the high volume phase if:

- You did not take any positions

- You entered on a retest of the reversal / breakout point

- You did not get run over more than once

- You were quick to exit if / when the market moved against you

- Took a profit greater than your risk (to make the higher risk worthwhile)

Exercise Money Management Rules

These are general money management rules for whichever strategy you trade. You should not lose more in one day then your average daily profit. This number is your maximum daily drawdown. For futures markets a reasonable rule is 10 ticks (thick markets) to 20 ticks (thinner markets) for your stop loss for the day. On any given trade you should know you are wrong between 1 and 5 ticks depending on the liquidity at prices so you can take multiple consecutive losses within your money management rules. If you reach your stop level for the day then you are finished for the session.

- Ideally you should aim to reach on average three profitable trading days per week, one losing day and one scratch / breakeven day.

- If you have two successive losing days then make sure you are not making any rookie mistakes. Review the instructions for previous exercises. Reduce your drawdown by a third and if this is reached then do not trade until the following week.

Proprietary Trading firms will stop traders if they reach their maximum drawdown in a trading session. Some brokers will provide a similar service. This allows you to trade another day, which gives you one more day of market experience to learn from, and potentially profit from. Too many retail traders end their chances of success early in the game simply by taking too big a hit on their losses and then cashing in on profits too early. It’s a market cliché but on some level, successful trading is purely about cutting your losses early and letting your profits run and being around long enough for this formulae to play out. If you are able to internalize this market rule then you are ahead of the curve.

Trade Like a Machine Exercise Goals

Regardless of the trading system you use for this exercise, you should be trading as mechanically as possible according to your rules and following the above money management principals. You should:

- Take every trade (work orders or hit in)

- Logically manage the trade manually (win, scratch or loss)

- Manage your emotions (remember the three C’s – Cool, Calm and Collected for each trade)

- Respect the money management rules

- Take 3 weeks or 100 trades without breaking the above rules

This has been a lengthy exercise description. If it seems complex all we are trying to do is trade like a machine. If you are caught in a loop trying to make sense of the default system or justify border line trades, just use common sense. You will know if you have traded impulsively, taken boredom trades and broken the rules of your system. Review your trades at the end of each session keeping in mind Exercise #1 and Exercise #2 review points. Remove rookie errors. Rinse and repeat and try for 100 good trades, one at a time.

Resources

https://youtu.be/zCyqylqgrT0&modestbranding=1&rel=0&iv_load_policy=1&autohide=1&start=8&showinfo=0