When we are sitting at our trading desk, enthralled in numbers on a screen or objects on a chart, it is easy to think the market is actually based in these symbols fluctuating on our screens. We consider the market is going up, when the bids and offers step up the ladder, or a candle stick stretches itself upwards. The market is not on your computer screen though, or even in your computer. It is not even the data stream that bounces around the world from the exchange to your data provider, to their closest geographic server and then finally to your computer. The market is an unknown, hidden beyond the pulses of market data, orchestrating the information you view from all corners of the globe, including from your own trading desk. At any one moment algorithms and traders everywhere in the world are ‘The Market’ and the closest thing you can get to observing it, is actually by observing yourself. This is because you are a part of the collective market, and your impact on the market is a result of the data you observe which is actually market feedback – a kind of continuous loop whenever you are actively trading.

The price you observe on a screen in plane number form is essentially a heuristic of the market as a whole, necessary so you can make a decision on what point in time you are going to buy or sell. But then it is common practice to create heuristics of this Price and Time heuristic by rearranging the data visually into candlesticks or market profile charts. And then there are mental processes that observe the already visually rearranged data, and translate it internally once more through cognitive processes necessary to give meaning to the data. For a lot of traders this involves distorting the information even more to conform to the traders existing beliefs about the future of prices and / or filtering out market information because of the emotional state of the trader. The discretionary trader has at least the aforementioned processing layers continuously corrupting and complicating the once simple market feedback information.

Changing our market focus is a good way to get back to basics and actually achieve the goal of buying low and selling high (and vice versa).

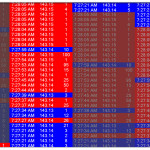

Focusing on the tape, or the DOM is one of the easiest ways to avoid the processes that distort and filter the market data before we make decisions with it. By observing the raw price and volume action you are getting the most direct feedback loop for market cognition. This is possibly why most successful derivatives traders only need these simple tools to trade successfully.

As stated previously, the market is not contained in the symbols on your screen, they are just heuristics for market feedback. This market feedback information can be expressed in different modalities (forms). You could probably Feel the tape through some contraption and get enough information to trade successfully. However feeling is a much slower cognitive process than listening. We are hard wired to respond to sound much quicker than all our senses including light. We also have evolved a much more direct neurological structure for recognizing and processing audio patterns which is why sounds can be used to alert us to act subconsciously. You might want to try and test your reaction to sound here. We are also listening to our environment 24×7 and have amazing processing abilities of complex sounds.

and you will get some idea of our audio processing abilities.

Most traders ‘trade’ by waiting for the visual symbols on their screen to change, and then process and eventually act on it (unless they are gambling). Usually they are presented with an overload of other visual information that can conflict, or bias their opinion of the market at the same time, such as a potential chart formation that might be complete if this current candlestick stretches a little further south.

without the distraction of derived visual patterns that tend to confuse the message of the data. Focusing on the raw audible market information will develop neural pathways similar to the ones that recognize your significant other’s emotions in the tone of their voice, or the sound of an approaching vehicle. You become more connected to the market feedback information and develop a feel for the flow of events unlike any sequence of numbers on a screen.

Neuroscientists (and marketers) also know that using multi-sensory convergence (e.g. matching of sound and vision) is an extremely powerful way for embedding patterns in the brain. So watching the DOM or Tape AND Listening to it will make connections in your brain so you can recognize and process the collective market behavior even more efficiently. This phenomena is researched as the ‘binding problem’ and is exploited by smart advertisement campaigns to embed patterns in your brain you won’t forget.

If you want to SUPERCHARGE your trading performance and market intuition, then put some headphones on and listen to the market. You will be amazed at how well you can gauge the collective markets behavior from an audible perspective, connecting patterns in the market data that you were staring at this whole time.

Note: Comments have finally been enabled for this blog so feel free to share your thoughts below