Using PriceSquawk through Jigsaw’s Reconstructed Tape has a number of advantages which will be discussed in this and subsequent blog posts.

For those not familiar with the Reconstructed tape (‘Recon tape’) which is included in the Jigsaw Trading Tools package, it is an intelligent Time & Sales tool that exposes the market orders placed by traders which are usually split up at the exchange. The reconstructed market orders, a form of aggressor order, give a clearer representation of the sentiment of traders in the immediate order flow as you can distinguish the actual size Buyers and Sellers are trading, who are willing to give up the inside market spread to have their orders filled. This information is usually masked in your data feed, where larger market orders may be broken down to match smaller resting / limit orders. For example a 100 lot buy at market that is filled entirely against the inside offer, could be reported in the normal time and sales as up-to 100 X 1 lot orders filled at the inside offer. The Recon Tape will attempt to reverse the matching algorithm and report the original 100 lot aggressor order.

Of course there are many ways large traders can still hide their activity, and market orders could just as likely be traders bailing out of positions as well as entering directional out-rights, and then there are auto-spreaders etc, so context is key when interpreting this information.

When used with the Recon Tape, PriceSquawk sounds represent the time and sales entries as displayed in the Recon Tape, and you will receive audible feedback of the entire trade volume of aggressive buyers and sellers. For example, if listening to all Time and Sales sounds, you would be able to audibly identify a 100 lot buyer at market, as opposed to 100 X 1 lots at the other extreme. This gives a clearer perspective of which traders are more aggressive during key market phases.

Listening to an unfiltered Recon Tape

Adding the Recon tape to your trading toolkit provides direct feedback of the flow of aggressor buying and selling occurring. You can add the PriceSquawk / Reconstructed Tape configuration to your trading setup to stay constantly in tune with order flow developments. During the primary trading session you will more than likely only notice if the tape is moving fast or slow, and if buyers or sellers are more active based on the color of time and sales entries. The actual size of trades will largely go unnoticed unless you are filtering the recon tape heavily.

By enabling PriceSquawk for the unfiltered recon tape you will immediately notice the difference between visual and audible perspectives of the same information. A large trade will always be heard for instance, where visually it may have been disappeared from the Time and Sales too quickly to notice, and the size text could take too long to visually process. For example think about how much mental work it takes to recognize a loud buy beep vs reading the moving text ’10:23:35.002 222 2100.23 At Ask’. The loud Buy beep incorporates sufficient information to reduce this time and sales entry into one sound, with loudness representing the buying size, the particular beep meaning the trade occurred ‘At Ask’, and the pitch can represent any price change information. You are actually better equipped for processing complex and quickly changing information audibly though this is an in-depth topic to cover another day.

Selecting your preferred Buy vs Sell sounds

Each trader is going to have their own preference. The following examples demonstrate various Buy and Sell combinations for representing entries in the Recon Tape.

https://youtu.be/6_0Vjma14bE

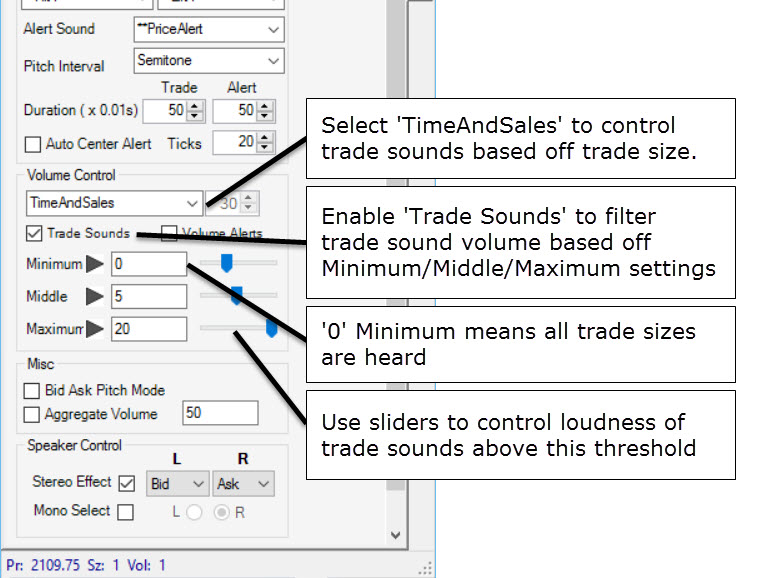

Getting a Feel for the Tape

For the market you are trading – use your experience to configure 3 tiers of traders in your PriceSquawk Time and Sales settings. If you want to hear all trades set your Minimum threshold to ‘0’. Then enable PriceSquawk using one of the above example buy / sell sound configurations for a trading session to get a feel for the tape and how buying and selling behavior changes during different market phases. Pure Tape traders should be able to form a bias simply from this audible information but for now you are just developing a feel for the market mood directly from the recon tape. The most important feedback is the speed and the loudness of tape sounds. Then you can also identify the price action from the pitch change of trade sounds.

To get started listening to basic trade sounds open PriceSquawk from the Recon Tape – and configure some basic Time And Sales settings from the ‘Config’ tab. Listen to the tape using this configuration for at least one hour to get a feel for how the tape flows in different market phases. Here is an example PriceSquawk configuration for the E-mini.

This is a basic configuration that can be used with a PriceSquawk ‘Lite’ license. If you want to hear a powerful tape configuration – select the ‘E-mini Tape Sounds’ configuration from the PriceSquawk Settings selector. This will increase the loudness of trades with the speed of the recon tape (volume increasing = louder trade sounds, volume decreasing = softer trade sounds). You will also get individual alerts in the form of digital down and up sweep sounds, which represent large block trades of 50, 100 and 500 contracts, the bigger the trade, the louder the alert.