In the fast-paced world of trading, every edge matters. While most traders rely heavily on visual information—charts, order books, and time & sales displays—there’s an underutilized dimension that could provide you with crucial market insights: sound. This is where PriceSquawk enters the picture, transforming market data into audio signals that complement your visual trading tools.

What is Decision Support in Trading?

When we talk about decision support with PriceSquawk, we’re not discussing a magic solution that automatically generates trading ideas. Instead, think of it as adding a new sensory dimension to your market analysis. Just as your eyes process charts and order flow, your ears can now interpret market movements through intuitive audio cues. This dual-sensory approach often proves more intuitive and less fatiguing than visual analysis alone.

Managing Expectations

Many traders new to PriceSquawk assume they’ll immediately start generating trading ideas from the audio feed. While this is possible—and some traders do report audio pattern detection as their primary benefit—it’s an advanced skill that takes time to develop. Your initial goal with PriceSquawk should be to provide supplementary order flow feedback for short-term trading and scalping, which will offer insights that might be missed through visual analysis alone.

Origins and Development

The development of PriceSquawk’s audio cues was driven by real trading needs. As I discussed in my Band of Traders podcast interview, the various sounds were originally designed to help traders follow size, accumulated volume at price, and inside market activity when trading Eurex instruments. Many traders discover they prefer putting more emphasis on PriceSquawk’s audible information due to our natural sound processing abilities and the clarity of audio signals.

Core Configuration Options

Following are two powerful configurations that traders commonly use to enhance their decision-making process:

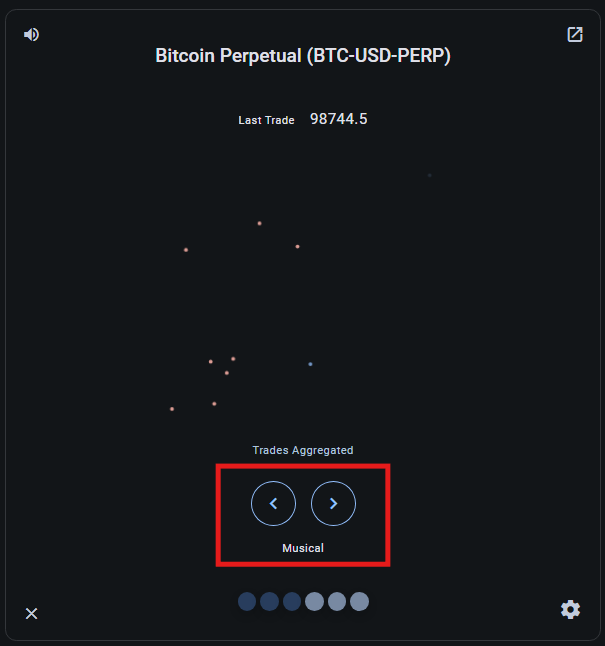

1. Market Rhythm Mode with the Trade Sounds Widget

The sounds dynamically adjust to market activity—becoming more prominent during increased trading and quieter during lulls. This natural rhythm helps you sense market momentum and identify trading opportunities, or risky conditions to be in the market.

Key Benefits:

- Seamlessly integrate Order Flow feedback without additional visual clutter

- Build market intuition passively while listening rather than constant visual focus

- Process trade information more intuitively through sound than reading numbers

- Increase your information processing bandwidth and find more opportunities and be more aware of market conditions

Optimization Tips:

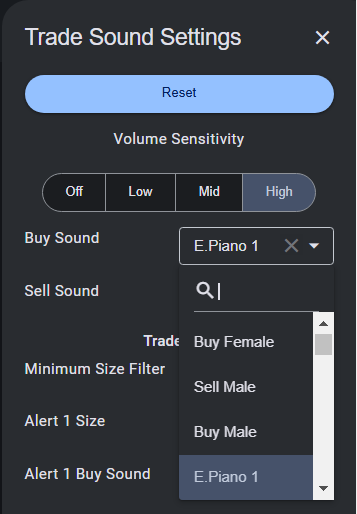

- Start with provided templates and experiment with different sound effects

- Choose Buy and Sell sound effects that you can comfortably listen to for extended periods. Some traders prefer the speech e.g. ‘Buy’ / ‘Sell’, others prefer musical or percussion sound effects.

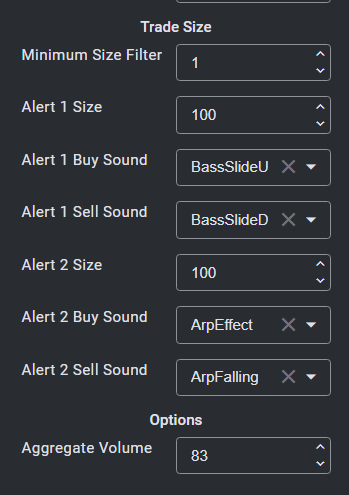

- Set a minimum size filter to prevent audio overload

- Fine-tune the Aggregate Volume setting for optimal clarity

- Experiment with sensitivity settings to match your trading style

2. Cumulative Volume Delta with Tape Pressure Mode

Cumulative Volume Delta (CVD) is a powerful metric that tracks the net balance between buying and selling volume over time. Rather than just showing individual trades, CVD helps reveal the bigger picture of whether buyers or sellers are dominating the market. PriceSquawk’s Tape Pressure mode transforms this critical information into intuitive audio signals.

How It Works

When using Tape Pressure mode, PriceSquawk analyzes the CVD over rolling 10-20 minute windows. Instead of focusing on individual trades, you’ll hear audio signals that represent significant shifts in buying versus selling pressure. For example, if the market shifts from seller-dominated to neutral, you’ll hear buying pressure signals that reflect this positive change in CVD. Traders then use this for decision support in forming a bias or managing a position.

Key Benefits:

- Experience market imbalances through clear audio signals

- Detect shifts in market sentiment before they appear on charts

- Monitor CVD trends without constant visual attention

- Combine volume, momentum, and sentiment feedback in a single audio stream

Real-World Applications:

- Position Management: Hear when market pressure aligns with or contradicts your position

- Entry Timing: Use audio cues to identify potential turning points when CVD shifts

- Risk Management: Detect changes in market dynamics that might signal the end of a trend

- Bias Confirmation: Get audio confirmation when volume supports price movement

Optimization Tips:

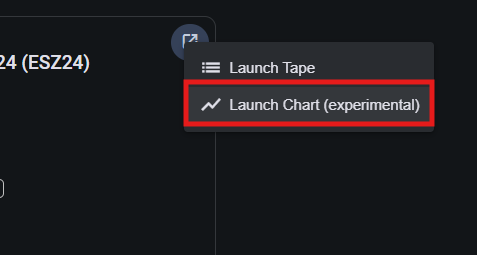

- Start with the Tape Pressure chart visible

- Watch how different audio signals correlate with market moves

- Learn to recognize the patterns that precede significant price changes

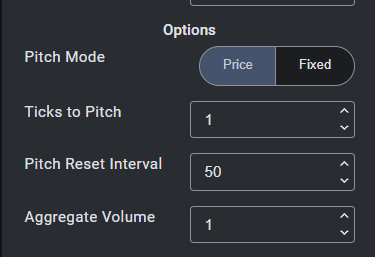

- Fine-tune Your Setup

- Enable Price Action mode to hear pitch changes that reflect price movement

- Adjust sensitivity based on your timeframe and market conditions

- Use the Aggregate Volume setting to find the right balance of signal clarity

- Understand the Signals

- Strong buy signals indicate CVD shifting positively

- Strong sell signals show CVD moving negatively

- Signal intensity reflects both the size and speed of CVD changes

Important Note: The Tape Pressure signals reflect changes in CVD direction and magnitude. A buying pressure signal doesn’t necessarily mean the overall CVD is positive—it indicates a positive shift in the CVD’s direction. For example, if CVD moves from strongly negative to neutral, you’ll hear buying pressure signals even though the absolute CVD might still be negative.

Through the combination of Market Rhythm Mode and Tape Pressure Mode, you gain a comprehensive audio picture of both immediate market activity and larger volume trends. The key is learning to interpret these signals within the context of your trading strategy and market conditions.

Training Your Audio Edge: A Step-by-Step Guide

Trading with audio signals is a skill that develops over time, much like learning to read charts or interpreting order flow. Just as Time & Sales became a valuable addition to traders’ toolkits, PriceSquawk offers a new dimension of market insight—one that becomes more powerful as you learn to interpret its signals.

Phase 1: Initial Observation (First Week)

Your first goal is simple: get comfortable with the audio environment. Don’t pressure yourself to trade based on the sounds yet.

Day 1-2: Basic Familiarization

- Watch the DOM/Tape while listening through quality headphones or speakers

- Focus on the overall rhythm rather than individual trades

- Notice how market sounds change during:

- Different times of day (opening, lunch, closing)

- Various market conditions (trending, ranging, choppy)

- Volume surges and quiet periods

Day 3-5: Active Observation

Start the “Trading Naked” exercise:

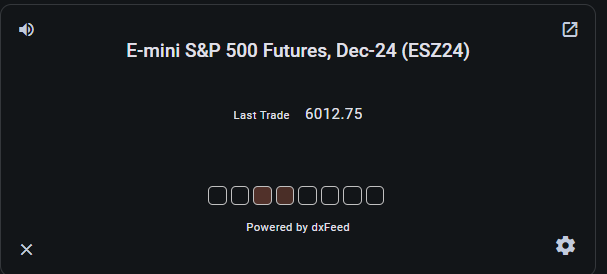

- Open a chart tab from the PriceSquawk widget to record the trade sound intensity or tape pressure signals during the session and minimize this

- In your execution platform use a single DOM and market

- Listen to market sounds for 10-15 minutes

- Emphasize using the audio for reading the order flow before placing trades (on the SIM)

- Use the exercise review period to compare your audio-based entries and exits with hindsight price action and audio signals (from step 1)

- Journal any patterns you have noticed in the audio

Be sure to review the original Trading Naked exercise for context on this exercise.

Phase 2: Pattern Recognition (Week 2)

Size and Flow Patterns

- Identify typical trade sizes in your market

- Note sound patterns that precede significant moves:

- Does heavy volume always mean direction?

- What happens after periods of silence?

- How do sound patterns differ between fake-outs and real moves?

Audio-Visual Integration

- Watch a 1-minute chart while listening

- Note relationships between:

- Sound intensity and candle size

- Audio patterns and support/resistance levels

- Volume sounds and price rejection points

Phase 3: Background Monitoring (Ongoing)

This is where PriceSquawk’s unique advantage becomes clear—your ability to monitor the market while focusing on other tasks.

Passive Monitoring Exercise

- Enable PriceSquawk while doing other work

- Note which sound patterns trigger you to take a look at the market

- Document what market conditions created those attention-grabbing sounds

- Start identifying high-probability setups based on audio cues

Advanced Pattern Recognition

- Size Threshold Analysis:

- Track the minimum size that typically influences price

- Note how size impact changes throughout the day

- Document size patterns around key price levels

- Buy/Sell Balance:

- Learn to hear imbalances in trading activity

- Notice how the sound balance shifts before reversals

- Correlate audio patterns with trend changes

- Price Action Correlation:

- Monitor how aggressive sounds relate to price movement

- Learn to identify stop runs through sound patterns

- Develop a sense for when price and sound diverge

Common Challenges and Solutions

Challenge: Information Overload

- Solution: Start with higher size filters

- Use trade Aggregation to combine trades for clarity

- Change sound effects used to improve clarity and reduce intensity of the sound

Challenge: Distinguishing Important Signals

- Solution: Focus on obvious changes in sound patterns e.g. more buy trades vs sell trades

- Use the Tape Pressure chart for visual confirmation (initially)

- Relax – Using Audio for decision support is a skill you are developing

Challenge: Maintaining Concentration

- Solution: Use 30 minute blocks of focused pattern recognition followed by a period of background monitoring

- Start with a shorter trading session (2-3 hours max)

- Use background monitoring to focus only when volume is present

Remember: The goal isn’t to replace your visual analysis but to enhance it. Let your audio trading skills develop naturally, and don’t force trades based solely on sounds unless you feel you have developed strong pattern recognition.

As your experience grows, you’ll likely find certain sound patterns that align perfectly with your trading style. These become your audio edge—reliable signals that complement your existing strategy and help you make better trading decisions.