The following is taken from the December newsletter:

Whichever way you are using PriceSquawk, realise that listening to the market is a natural edge. A typical trader may have multiple monitors such as Jimmy below.

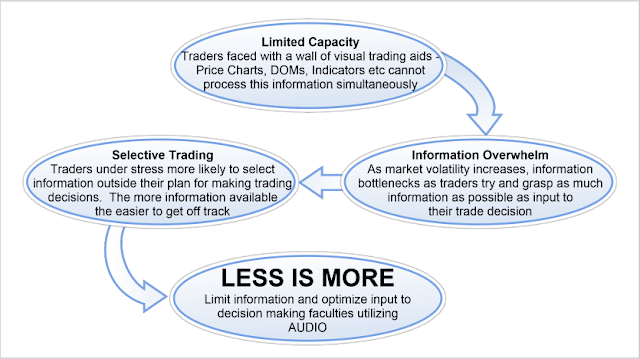

For the majority of us humans, this amount of information is counterproductive to making good trading decisions for a number of reasons:

Limited Capacity – We cannot monitor all the information on our trading monitors at once. For most of us, information is scanned like a bar code reader across the monitors. This takes time as the visual faculties collect and process the market data and we try to reach a conclusion on the information using sequences similar to the following:

This could very well be a successful discretionary strategy IF we have the discipline to ignore all the dynamic information on our screens that may support or negate our decision process at any moment in time.

Traders also tend to get stuck in visual loops, trying to gather information to make a case, such as between the Read Market X DOM and Read Market Y DOM steps above. Ultimately as the emotional temperature of the market reaches that point where the best opportunities are usually presented – the 1% simply know what to do, while the 99% are stuck in that loop, or reading a random chart or market DOM outside their plan. At this point it is inevitable to experience the next reason too much information is counterproductive:

Information Overwhelm – We can only process so many chunks of data at a time and during a period of time. This limitation is amplified when the information input is via only one of our senses, as it bottlenecks at our mental processing faculties which have to categorise and compare the incoming information stream with that stored elsewhere in our brains. As the information bottleneck occurs we become more distressed and subsequently overwhelmed which is not ideal for making trading decisions in the heat of the moment. Once overwhelm occurs, with the masses of information the majority are facing on their monitors, it is so easy to select whatever information you want to see as input to your decisions. This leads us to:

Selective Trading – Our guy sitting at his matrix of monitors is now sweating in the heat of the moment. His plan has gone as far as a plan can take you – and now it is up to his skills to manage a trade, as in entering, monitoring and exiting a position in the market. This is where our hardwiring does us no favours and is dealt with in classic trading psychology books such as Trading in The Zone by Mark Douglas. Our inclination with the markets is to filter out information that hurts us, and only select information that proves us right, which effectively hurts us even more. The vulnerable overwhelmed trader staring at their screens can now take their pick of any of the myriad of indicators, levels, price action signals or order flow patterns visible on their screens to back them up in entering a trade outside their risk parameters, or trigger them to exit a position prematurely.

Less IS More – This leads me to the conclusion that less is more which is one of the major benefits of listening to the market for making trading decisions. With just one instrument configured with PriceSquawk, traders can simultaneously interpret Price Action, Volume and Bid / Ask strength from the sound of consecutive notes, thus significantly reducing the amount of chunks of information necessary for market interpretation. Selecting alerts for important levels can reduce interaction with charts even more.

One question you might want to ponder is if you really need to know the actual numbers of markets or be aware of the figures on your screens? Price X is trading up to a support level Y. 1456 traded at X and previously 3200 traded at Y etc. What you really need to know is the change in this information, which is the motion of price and the interaction of volume and price ie less volume is trading as price increases. These are the core components of ‘Order Flow’, and they can now be monitored without looking at a screen.

Who is going to be more relaxed and thus able to get in the zone when push comes to shove; The trader scanning the screens with laser beam style focus for all the different pieces of the puzzle, or the trader sitting back calmly listening to the ebb and flow of the market, and a couple of DOMs for managing trades and a perhaps a basic chart for reference?

I encourage you explore reducing the amount of visual information you are leaning on for making trade decisions; it might be adding unnecessary distress. Automatic trading systems, like this Bitcoin Era Login, are far more effective at taking in market variables and making complex, objective decisions based on these variables. The edge as a day trader I believe comes from our subconscious processing (intuitive) abilities, and in order to create the optimum environment for intuitive trading –

There is also the matter of the benefits of audible information over visual information. I would argue that audio has a more direct path to our mental processing faculties than visual, i.e. we can respond more effectively to the market using sound. I will explore this topic in the future.